Mystery Dude Haunting Turkish Traders with Massive Bets

Some of you may remember how nearly two years ago a mysterious investor rattled the market at Borsa Istanbul throwing $450 million of bets on a single day (nearly double the market average at the time). Now the so called “Dude” also referred to as “Herif” is back. It is possible that the historically rather volatile market has become an easy target to better experienced players.

Financiers from Istanbul Portfolio have been trying to dig out the identity of the phantom for months now with no luck. Borsa Istanbul has a relatively new platform for online betting, having moved its servers to a new data center only late last year. The high hopes for attracting new business from online traders with the faster and better connection are materialising but not quite as expected. It is a new market and so there is still the “Big fish in a small tank” effect. To achieve a similar result on the LSE for example, one would need much deeper pockets, making it virtually impossible to create such noticeable fluctuations with just a single investor.

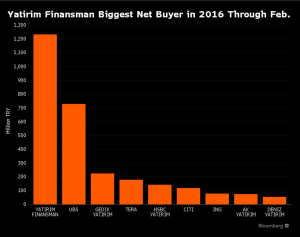

European bank’s clients are rumored to have stopped trading short-term Turkish stocks until the situation becomes more transparent. “Herif” single handedly has helped raise the average daily trading volume on the Borsa Istanbul with nearly 8 percent in 2016 so far. This compared to the 15% drop in Warsaw and 27% decline in Moscow places the Borsa’s 100 Index in the front run, beating by 13% Russia’s Micex and Poland’s WIG20 indexes. As you can see from the graph below (source Bloomberg), Yatirim Finansman has now under its belt the majority of all trades. Just two years ago the company (which is the first Turkish brokerage house founded back in 1976) handled less than 2 percent.

Local exchange firms such as Ak Portfoy, Gedik Yatirim and Meksa Yatirim announced they cannot comment and are not permitted by law to reveal client data.

Figen Ozavci (Meksa Deputy Chief Executive Officer) believes the switch over to a brand new system last year made the market “vulnerable to harsh swings” since the move was too quick and the local investors didn’t have time to adapt to the much more sophisticated trading system. It is possible that “the Dude” is simply a more experience player taking advantage of a new market with clever trading algorithms. One thing is sure – the competition will soon catch up.

Read More →