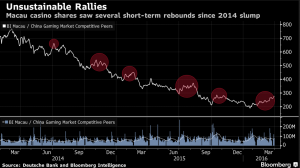

To cut long story short, gaming revenue in the first quarter dropped 16.3 percent to 18 billion patacas ($2.3 billion) in Macau according to Bloomberg. Still, Las Vegas Sands, Wynn, Melco Crown, Galaxy have highly optimistic predictions for the Q2 of this year.

The Background

Without making too much noise about it, Asia has consistently been doing well economically speaking, with double digits growth between 1999 through the 2000s. Today, as all the worldwide economies have slowed down, they still account for 40% of global GDP growth (compared to 25% in the early 90s). Poverty has dropped from 55% to 21% and health, education and infrastructure standards have improved for millions of people. And most of that is thanks to China. Just to put things in perspective – for this year the (pretty realistic) forecast is 6,5% GDP growth for China and the (most optimistic) one for USA doesn’t go above 2,2%.

The Reality

It is an interesting and little known fact that the growth of China began as and is mostly due to a massive migration of 250+ million people from rural areas to the bigger cities. With the accumulated savings from living modestly and off their lands, those people had money to spend. And where do you think that went? Whoever thought of casinos got it right. Micro areas like Macau flourished and grew with the new flow of capital. Similar was the reason behind the real estate and industrial booms. The demand for mass production from the West and for jobs for the new-comers to the cities saw China growing factories like mushrooms after the rain – a growth that has not yet been seen anywhere across the globe.

Every miracle lasts for three days as they say (well, in this case a “bit” longer but still). Competition for the cheap labour and skilled workers has aroused in the face of Vietnam, Thailand, the Philippines and India. The so called “reverse migration” is a new thing in China now – people going back to their villages after the closing of factories, and trying to start small businesses. This logically makes them unreachable and completely off target when it comes to gambling. Top that with the recent crack on corruption and you’ve lost the high-rollers as well, leaving not much for Macau’s casinos. Even the long-awaited Lunar New Year didn’t help as much as expected.

The Future

Well, put it however you like but for the (at least) near future, China is still the biggest and most skilled workshop in the world. So even with higher average wages, likelihood is a good 60% or more of whatever you see and buy in shops is and will be coming from there for some time to come. And higher wages mean more money to spend for the people remaining in the cities. Which is good news for Macau’s resident gambling destinations. And let’s keep it real – 2015 was pretty bad on all fronts and they still got over 20 million people visiting. That is still 50% of the number who arrived at the Las Vegas Strip (41 million). Keep in mind that of those visiting LV, only 35% participated in gaming and only 12% pointed out that gambling was the main reason for their visit. So all in all, Outcome predictions are positive and we are hoping to see some slow but steady growth.